Try WISE

Get a Personalized Investment Portfolio

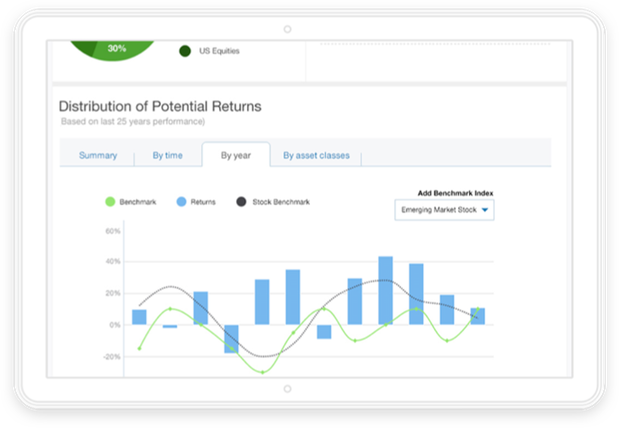

Answer the following questions and we will design a portfolio for you. You can adjust the portfolio to fit your needs. The returns reflect historical performance. We track historical performance for more than 25 years to help you make more informed decision.

This is a sample of the actual WISE journey.

WISE Investments from Gulf Bank provides customers with an advanced digital platform to start investing in diversified international markets in an easy, transparent, and cost-efficient way while keeping track of investment progress anytime and anywhere. WISE portfolios help clients achieve their financial goals and grow their wealth over time.

Easy

In few minutes, we create an investment portfolio that meets your goals.

Transparent

Monitor your investment portfolio anywhere and anytime.

Cost Efficient

One low fee and reduced taxes.

How it Works

Get to know you

Identify your investment objective, time frame and your risk score.

Create a plan

Guide you to create the optimal portfolio composition.

Invest your funds

We execute your trades and manage your dividends.

Expert guidance

Investment Advisors will monitor your portfolio.

Features

Innovative approach that allows you to monitor your portfolio from your personal devices.

Details of your portfolio composition and performance will be available on your Mobile and Online Banking, in addition to a periodic statement sent to your email.

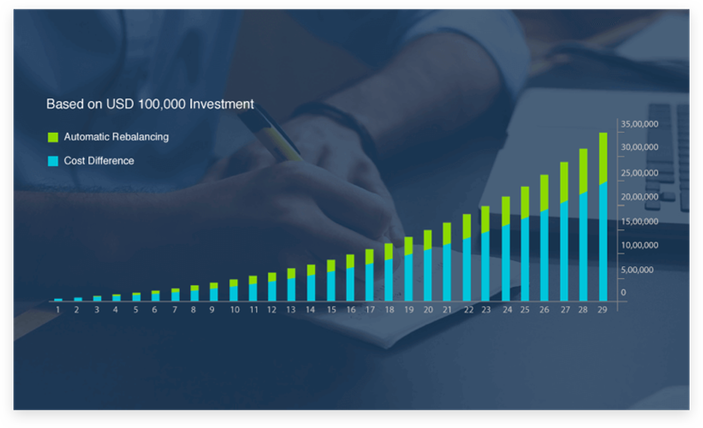

Costs cut from your returns, even a small difference in investment fees makes a big impact on your long term gains

Our goal is to keep the total cost of managing your investment under 1% without any hidden fees or commissions. Together with the yearly rebalancing benefits, WISE portfolios on average provides a 1.4% extra return to your investment.

| FEES |

| WISE | Typical Funds | |

| Subscription Fees | 0% | 1% - 2% |

| Redemption Fees | 0% | 0.5% - 1% |

| Management fees(Annual) | 0.85% | 1% - 2% |

| Additional Returns |

| Auto Rebalancing | 0.4% | 0% |

You can now invest with WISE Shariah-Compliant portfolio

Gulf Bank is pleased to offer customers an international investment portfolio in compliance with Shariah law. WISE Islamic portfolio will provide you with high exposure in international equities and gold to cater for your investment principles.

Meet Our Certified Investment Management Team

Rouquiah Al-Rifae

Investment Manager

Rouquiah Al-Rifae is a Senior Investment Manager with more than 15 years of experience. She is responsible for providing financial advice to private clients on a range of investment products and evaluating such products that fit the clients’ profile and financial needs. Prior to working at Gulf Bank, she was an Investment Analyst in the Commercial Bank of Kuwait (CBK), and had also worked at Kuwait and Middle East Financial Company (KMEFIC), analyzing stocks and managing in-depth financial valuations of different companies. Mrs. Al-Rifae earned her Bachelor’s Degree from the University of Denver in Colorado in the US.

Ahmad Al-Fuwaires

Investment Manager

Ahmad Al-Fuwaires is an Investment Manager with over 13 years of experience in the financial sector. He worked in investments and real estate development institutions before joining Gulf Bank in 2017. Al-Fuwaires had served as a board member in several companies and is a registered Investment Advisor Representative with the Capital Markets Authority in Kuwait. Ahmed holds a Bachelor of Business Administration degree with a focus in E-Commerce and Information Systems from Seattle University in the US.

Hanan Al-Ashwak

Investment Manager

Hanan Al-Ashwak is an Investment Manager with over 8 years of experience in the banking sector. She was a part of Gulf Bank’s development team that launched “WISE”, the first digital investment platform in Kuwait in 2016, and she is responsible for providing investment advise for affluent clients. Hanan is registered as an Investment Advisor Representative with the Capital Markets Authority in Kuwait, and has earned her IISI certificate in the investment field. Hanan holds a Bachelor’s Degree in Environmental Technology Management from Kuwait University.

Disclaimer

Gulf Bank offers restricted advice, limited to recommending a suitable model portfolio. We will not assess the client's full financial position, yet we will consider the client's disclosed financial circumstances. We do not provide tax advice. Gulf Bank cannot guarantee any level of performance and/or that any client will avoid a loss of account assets. Any investment in securities involves the possibility of financial loss (including the loss of principal) that clients should be prepared to bear if/when occurs. Past performance is no guarantee of future results, and historical return distributions may not reflect actual future performance.